Mapping Retail Stablecoin Activity Through Visa’s $45 Lens

What small-ticket stablecoin transactions tell us about adoption

The average transaction size on Visa’s network is $45

Earlier this week, on the recent podcast with the Visa Crypto team Cuy (Head of Crypto) and Noah (Head of Onchain Data), we launched a simple and elegant way of analyzing the stablecoin data with the benefit of one key data point that only Visa has:

Across all Visa transactions over the last 12 months (through March), the average transaction size was $45. (source)

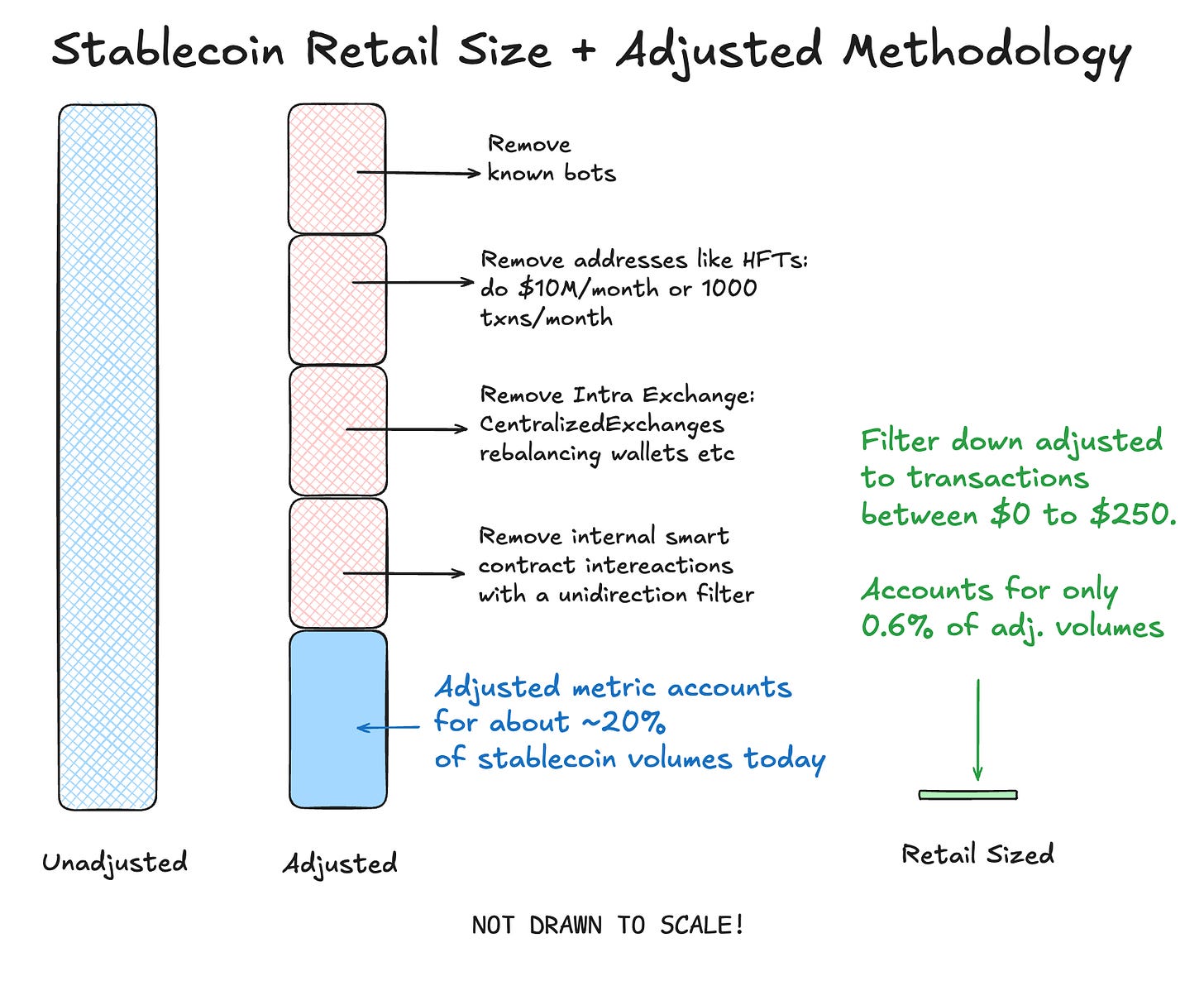

Unadjusted vs Adjusted vs Retail Size payments

Ok before diving into the data, quick refresher on the methodology we implemented for our Visa x Allium Stablecoin analytics dashboard.

We took that $45 average number and assumed that most of retail transactions would fall between $0 to $250. This kind of makes sense right? How many retail sized transactions does one make above $250 every day - people buy coffees, clothes and what not.

Methodology motivation: If we were to buy a coffee for $5 on Visa, that $5 flows through 2 different banks, one on the buyer’s side and the other on the seller’s (coffee shop), and through intermediaries like card network and processors. If all this activity was recorded on a blockchain, it would be many multiples of $5, but for the purposes for analysis, we only want to focus on the $5 payment for that cup of cortado.

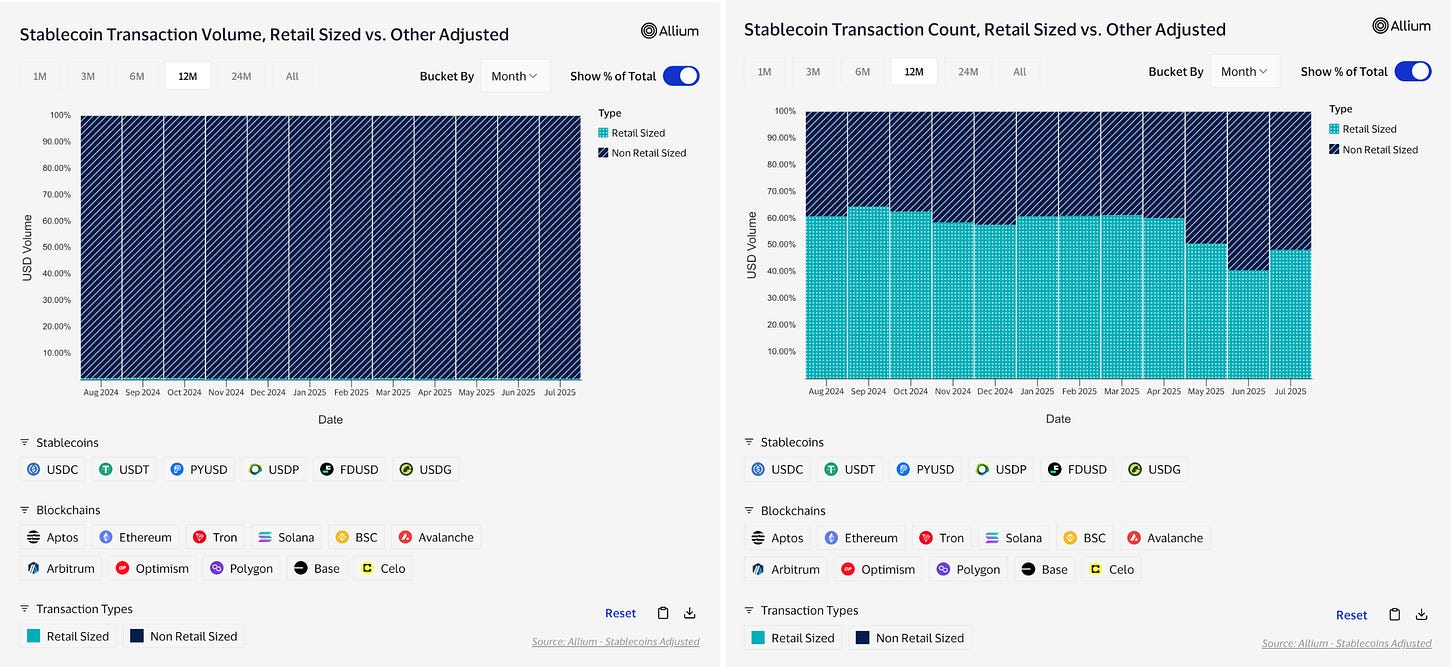

Despite retail-sized stablecoin transfers accounting for just 0.6% of adjusted notional volume, they make up ~40% of all adjusted stablecoin transactions.

We can see that the “retail sized” turquoise graph is barely visible on the dashboard as it is only 0.6% of adjusted stablecoin volumes.

This aligns closely with what we expect in a retail payments environment—small-ticket, high-frequency behavior. Buying coffee, sending money to a friend or paying a bill. Even though these payments are small, they dominate transaction counts, just like in traditional consumer spending.

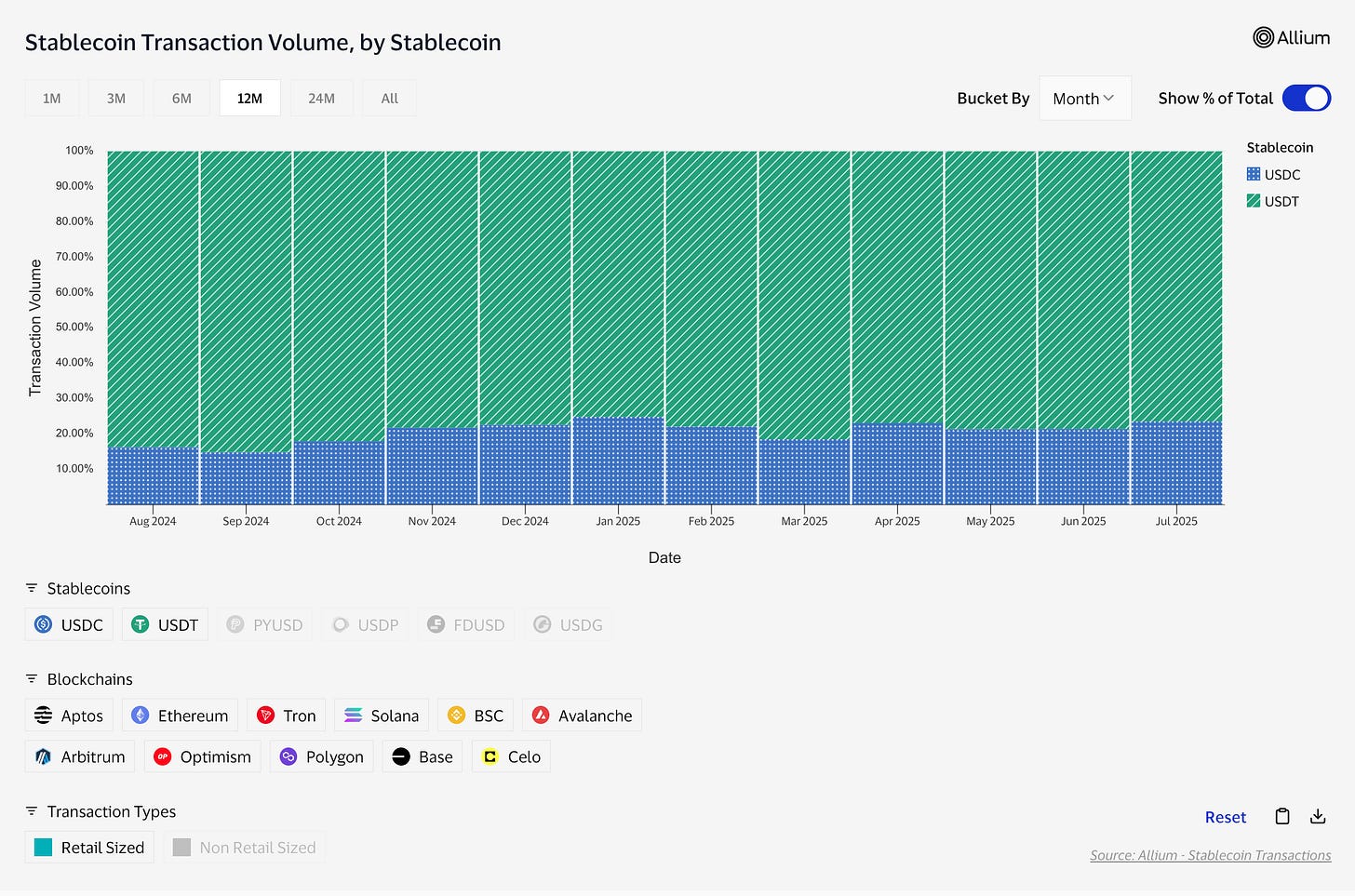

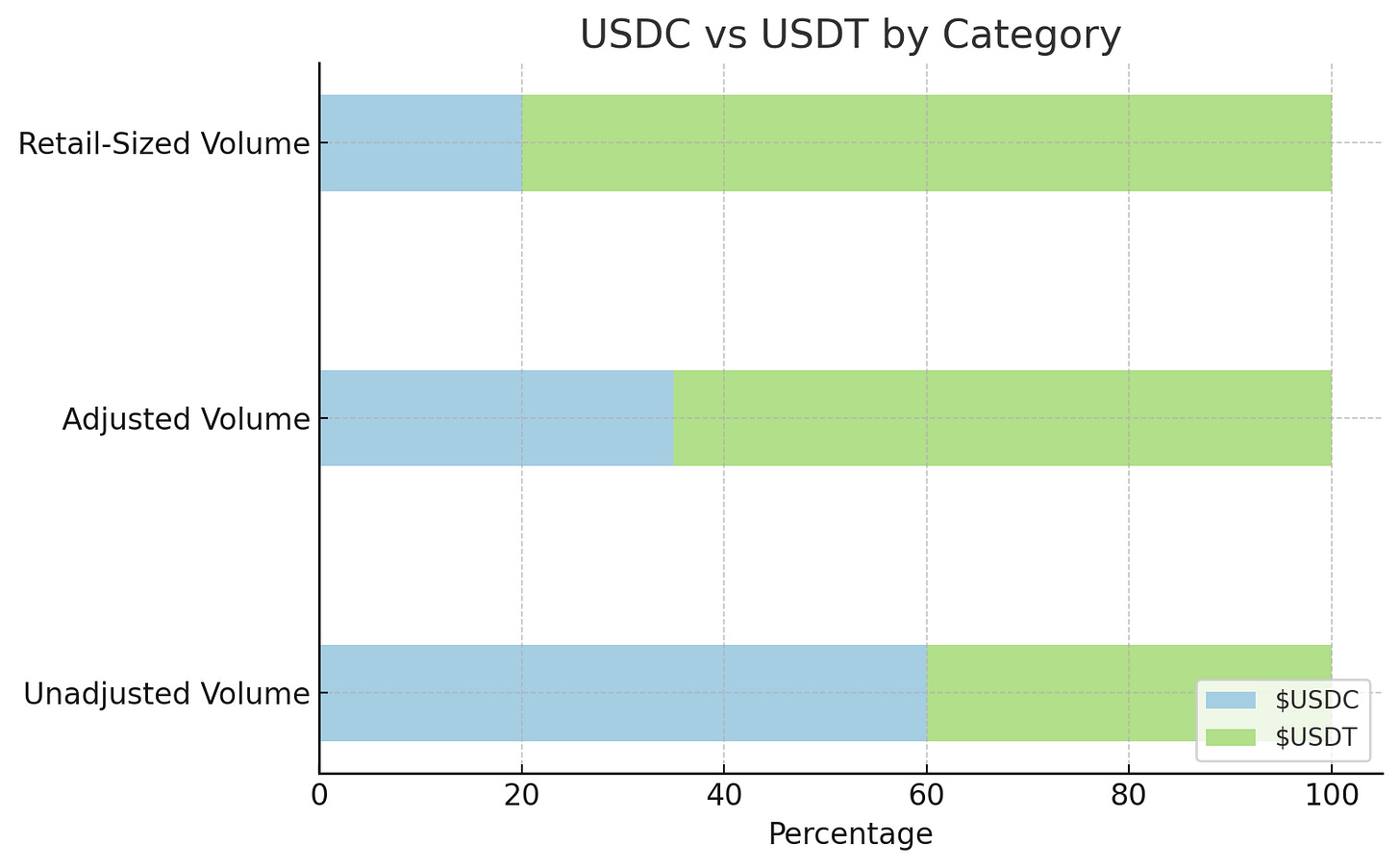

A closer look at USDC vs USDT distribution that are retail sized

~80% of retail sized stablecoin transfers are settled in USDT: we know USDT sees greater adoption in emerging markets, especially for everyday retail payments and cross-border transfers. This aligns with USDT’s role as both a unit of account and store of value in markets where local currencies are volatile or capital controls are strict.

~65% of adjusted volume stablecoin transfers are settled in USDT and only ~40% of all (unadjusted) volume stablecoin transfers are settled in USDT: This suggests USDC has stronger penetration in enterprise use cases like high-frequency trading, gross settlement, and B2B payments.

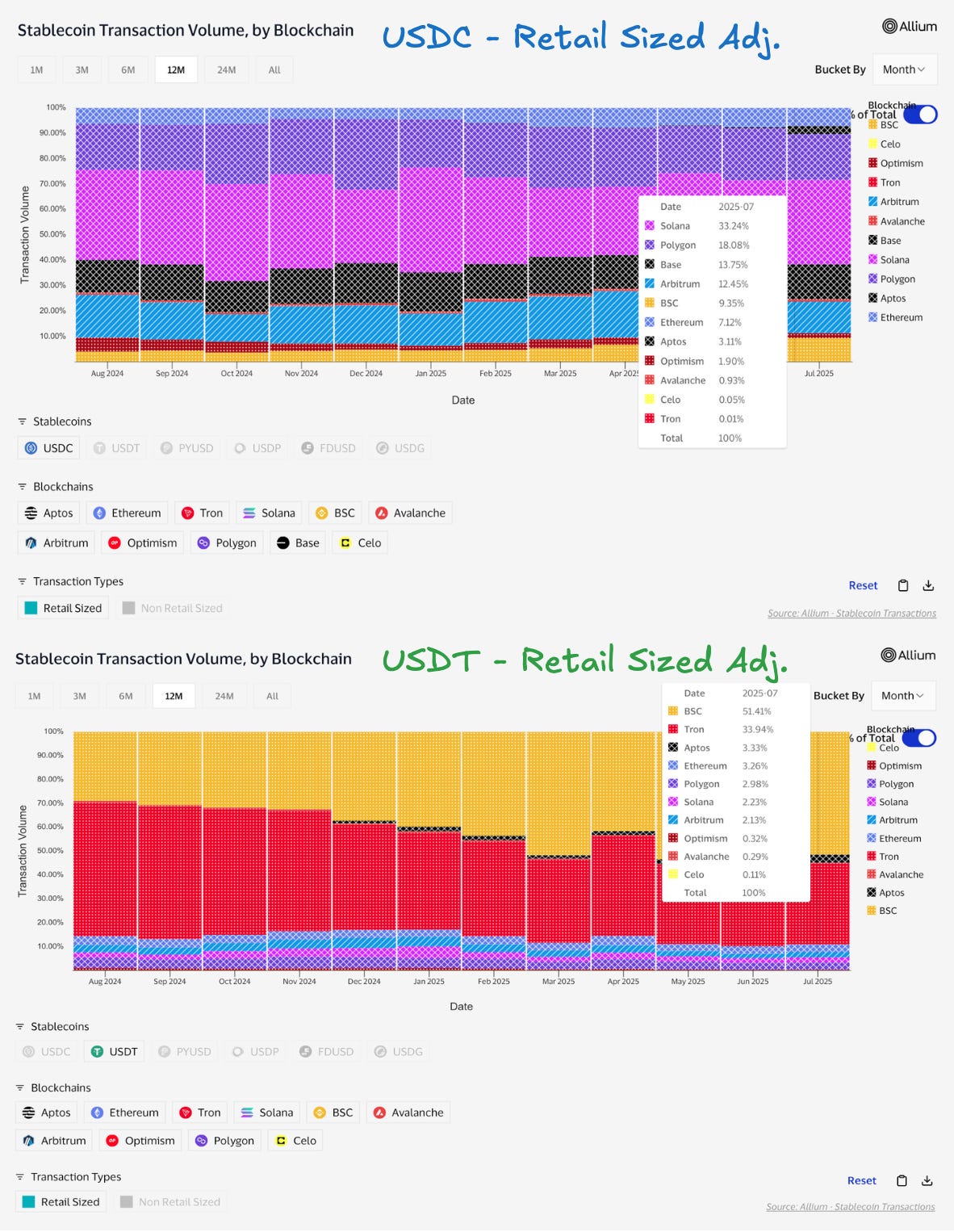

Retail size transactions breakdown by blockchains

Retail favors Low Fees + High throughput chains: It is common for both USDT AND USDC retail volume that they happen on High throughput chains.

76% of retail sized adj. USDC transactions are on Solana, Polygon, Base, Arbitrum while 85% of retail sized adj. USDT transactions are on BSC and Tron: This tracks as USDC is favored by US-based platforms while USDT dominates in emerging markets like LATAM, Southeast Asia where BSC and Tron are most accessible and commonly integrated into local wallets, exchanges and payment apps (Binance P2P, TronLink).

We’re still early!

Using a simple $45 assumption and retail sized filter, we get to see clearly the breakdown to guess what “real world” payments looks like today. These small-ticket transfers, though tiny in notional value, account for nearly half of adjusted activity transaction counts!

We’re still early in this journey, excited to track these metrics as the industry grows, and again welcome feedback as we navigate the mid curve together. For those who are curious, we covered some of the data discussions in the podcast here:

Special Thanks to

Cuy Sheffield, Head of Crypto, Visa

Noah Levine, Head of Onchain Data, Visa

Shank, Kickass Engineer, Allium

William, Head of Institutions, Allium

This is a great post.

Do you have a sense of the retail payments what % are primarily trading related vs commerce and interest bearing transactions?

I'd love to get a view on adoption esp in non-US markets. My primary guess is that it's all still early but growing, and that almost none of us have really spoken to these customers in person